Online banking

solution

Online bank

Online Banking system, which allows electronic transfers, sending documents between customers and the bank, with a fully protected data transmission channel. The advantages of our solution are - a fully understandable banking system, that allows customers to make a completely secure and easy flow of payment, documents exchange and required information to be shared with other banking systems (correspondents).

Key features

Online Banking administration

Correspondence with Customers

Customer and User Management

Document management

Authorization tools and security rules management

System monitoring

Agent/Refferal module

Integration via API with different Payment services providers

Account overview

Account

balances

balances

Extract/ Exports (CSV, FiDaViSta, XML, JSON)

Account statements

Payment document

management

management

Create, Send, Edit, Copy

Payment check

Payment archive

Payment bills

Payment bills

Securities

Solution

Future-proof your business with a fast, flexible and scalable core platform

Online banking system is designed by the bankers and developed by the young and ambitious coders. This symbioses provides good flexibility and high level of security the same time. System is designed the way, to be able to adapt to modern FinTech requirements with greater level of flexibility to be able to support required growth.

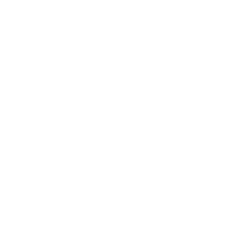

Front Office

Front Office is the most important part of any project, because this is the part seen by customers. However often this part don't have enough attention from the developers as it doesn't include technology features or any know-how. We provide reasonable level of flexibility, when using solutions as white label, you can use your own template or you can just add your logo to existing design and color scheme.

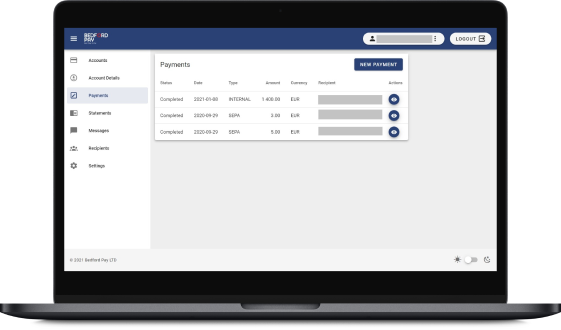

Back office

Depending on the needs different part of the Back office system might be available, so those parts what is not needed won't disturb operators, managers and anyone else who is working with the system. Solution has integrated user role models, it means that client manager will see different menus in the back office system, then AML manager.

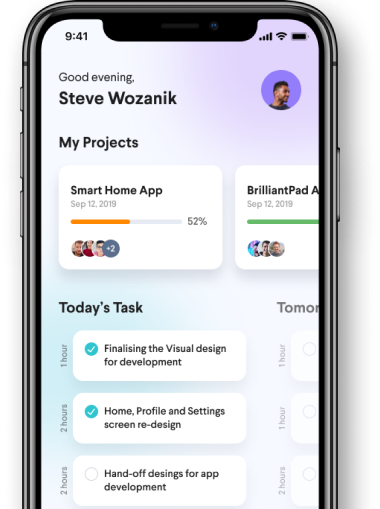

App

Basic functionality as push notifications - security codes, transaction information, balances etc. available to all white label users, however individual features could be added depending on project requirements.

Compilance, AML

Level of requirements for each company working in field of finance is growing every year. This part becoming critical for any business. System has specially designed module with aim to help Compliance team to do their work more efficiently. Some features included but not limited to: Country risk monitoring, Limits, Supporting documents check, Sanctions screening, Connection to well known databases.

Contact us

Contact us to grow or start new operations with the best banking platform that provides you modern, scalable and secure framework